MISTERI KEPATUHAN PAJAK

Abstract

Taxes are one of the major sources of state revenues. However, compliance must be a major problem that is difficult to overcome. The problem with halo is a classic problem, which will never end in many models. The purpose of this research is to reveal the factors that influence. The research method used is qualitative in need. Explore various factors that can affect. Factors that can cause wind tax evasion. From various sources finally found 3 dominant factors that can affect. In addition there are two factors that cause taxpayers to avoid taxes, namely: large sanctions and distrust obligatory to the government. So the trust of society or government is needed.

Keyword: compliance tax, tax avoidance

Full Text:

PDF (Bahasa Indonesia)References

Afifah, N. Y. (2013). Analisis Faktor-Faktor Yang Mempengaruhi Keputusan Tenaga Kerja Untuk Tetap Bekerja di Sektor Pertanian (Studi Kasus Kecamatan Pujon). Jurnal Ilmiah Mahasiswa FEB, 2(2).

Alabede, J. O., Ariffin, Z. Z., & Idris, K. M. (2011). Individual taxpayers' attitude and compliance behaviour in Nigeria: The moderating role of financial condition and risk preference. Journal of accounting and taxation, 3(3), 91.

Alm, J., Martinez-Vazquez, J., & Wallace, S. (2009). Do tax amnesties work? The revenue effects of tax amnesties during the transition in the Russian federation. Economic Analysis and Policy, 39(2), 235-253.

Andreoni, J., Erard, B., & Feinstein, J. (1998). Tax compliance. Journal of economic literature, 36(2), 818-860.

Chan, C. W., Troutman, C. S., & O’Bryan, D. (2000). An expanded model of taxpayer compliance: Empirical evidence from the United States and Hong Kong. Journal of International Accounting, Auditing and Taxation, 9(2), 83-103.

Chau, G., & Leung, P. (2009). A critical review of Fischer tax compliance model: A research synthesis. Journal of accounting and taxation, 1(2), 34.

Friedland, N., Maital, S., & Rutenberg, A. (1978). A simulation study of income tax evasion. Journal of Public Economics, 10(1), 107-116.

Ghosh, D., & Grain, T. L. (1996). Experimental Investigation of Ethical Standards and Perceived Probability of Audit on Intentional Noncompliance. Behavioral Research in Accounting, 8, 219-244.

Helhel, Y., & Ahmed, Y. (2014). Factors affecting tax attitudes and tax compliance: a survey study in Yemen. European Journal of Business and Management, 6(22), 48-58.

Hemberg, E., Rosen, J., Warner, G., Wijesinghe, S., & O'Reilly, U.-M. (2015). Tax non-compliance detection using co-evolution of tax evasion risk and audit likelihood. Paper presented at the Proceedings of the 15th International Conference on Artificial Intelligence and Law.

Lasmana, M. S., Narsa, I. M., & Sawarjuwono, T. (2005). Pengaruh Penerapan Sistem Monitoring Pelaporan Pembayaran Pajak (MP3) Terhadap Tingkat Kepatuhan Wajib Pajak (Studi Empiris Pada Kantor Wilayah Direktorat Jenderal Pajak Jawa Bagian Timur I). Jurnal Akuntansi dan Keuangan Indonesia, 2(1), 130-158.

Magro, A. M. (1999). Contextual Features of Tax Decision‐Making Settings. The Journal of the American Taxation Association, 21(s-1), 63-73. doi: 10.2308/jata.1999.21.s-1.63

Muturi, H. M., & Kiarie, N. (2015). Effects of online Tax System On Tax Compliance Among Small Taxpayers In Meru County, Kenya. International Journal of Economics, Commerce and Management. United Kingdom Vol. III(12), 280.

Puspitaningtyas, Z. (2013). Perilaku Investor dalam Pengambilan Keputusan Investasi di Pasar Modal.

Puspitasari, E., Nurhayati, I., & Meiranto, W. (2015). Teori Postur Motivasi Dalam Studi Eksperimen Keputusan Kepatuhan Pajak Di Indonesia. Proceeding Fakultas Ekonomi.

Puspitasari, E., Susilowati, Y., Nurhayati, I., & Badjuri, A. (2016). Postur Motivasi, Pengetahuan dan Perilaku Pelaporan Peer Wajib Pajak Orang Pribadi dalam Studi Eksperimen Keputusan Kepatuhan Pajak. Simposium Nasional Akuntansi XIX, Lampung.

Serim, N., İnam, B., & Murat, D. (2014). Factors Affecting Tax Compliance of Taxpayers: The Role of Tax Officer The Case of Istanbul and Canakkale. Business and Economics Research Journal, 5(2), 19.

Stella, P. (1989). Do Tax Amnesties Work? Finance and Development, 26(4), 38.

Team, M. Z. A. A. R. (2016). Konsultan Pajak = Pencuri Pajak (Revisi ed.). Surabaya: Artha Raya.

Wardiyanto, B. (2009). Tax Amnesty Policy (The Framework Prospective of Sunset Policy Implemantation Based on the Act no. 28 of 2007).

DOI: https://doi.org/10.30872/jakt.v14i2.1908

Refbacks

- There are currently no refbacks.

Copyright (c) 2018 Arif Farida

Editorial Address

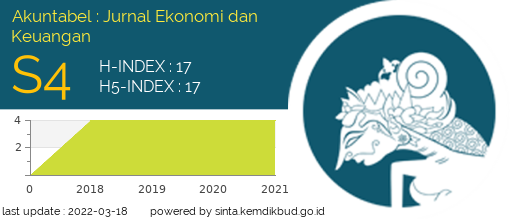

Akuntabel: Jurnal Akuntansi dan Keuangan

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jakt.feb.unmul@gmail.com

StatCounter: Akuntabel: Jurnal Akuntansi dan Keuangan