Pengaruh jumlah nasabah, tingkat suku bunga dan inflasi terhadap penyaluran kredit pada pt pegadaian di cabang samarinda seberang kota samarinda

Abstract

Testing the hypothesis in this study using multiple regression analysis models due diligence. Multiple regression analysis was used to determine the effect the effect of several independent variables on the dependent simultaneously or partially during any particular period. The results of the analysis obtained by linear regression equation as follows:Y = -119.190 + 0,024X1 + 82,319X2 - 0,157X3 Results of simple linear regression equation that shows the direction of the effect of each - each independent variable on the dependent variable, which is indicated by the regression coefficient variable. unknown value of R square (coefficient) of 0.917 or 91.7%. This means that 91.7% Loans (Y) on PT Pawn (Persero) Branch in Samarinda across the city of Samarinda is affected by the number of customers (X1), Interest rate (X2) and inflation (X3), while the remaining 8.3 % is the contribution of other factors not included in this study. The results of the analysis and discussion of the conclusions made are number of customers affect the loan portfolio in PT Pawn (Persero) Branch in Samarinda Seberang Kota Samarinda hypothetically accepted. The interest rate does not affect the loan portfolio in PT Pawn (Persero) Branch in Samarinda Seberang Kota Samarinda is the hypothesis is rejected. Inflation effect on Mortgage Lending in PT (Persero) Branch in Samarinda Seberang Kota Samarinda is the hypothesis is rejected.

Keyword: The interest rate, inflation, and Lending

Full Text:

PDFReferences

Baitulloh. Hendrik. 2011. Analisis Pengaruh Aplikasi Kredit, Tingkat Suku Bunga dan Tingkat Inflasi terhadap Pertumbuhan Kredit Kepemilikan Rumah (KPR) di Bank Danamon Indonesia, tbk Cabang Kuningan. Fak. Ekonomi Universitas Gunadarma. No. 10206423.

Farauk, Umar.2010. Analisis Hubungan Tingkat Suku Bunga Kredit Konsumtif dengan Volume Penyaluran Kredit Konsumtif pada Bank Swasta Nasional. ISSN: 0854-8986

Hassanudin, Mohammad dan Prihatiningsih. 2011. Analisis Pengaruh Dana Pihak Ketiga, Tingkat Suku Bunga, Jumlah Nasabah dan Inflasi terhadap Penyaluran Kredit Bank perkreditan Rakyat (BPR) di Jawa Tengah. Jurusan Akuntansi Politeknik Negeri Semarang.

Imawan.2013. Membaca Output SPSS http://.wordpress.com/2009/10/22/membaca-output-spss-managemen-keuangan/. Diunduh pada 24 Maret 2014

Kasmir. M. 2010. Manajemen Perbankan, Edisi Revisi, Cetakan ke Sembilan, Raja Grafindo Persada. Jakarta.

Kuncoro dan Suhardjono. 2005. Manajemen Perbankan,Teori dan. Aplikasi, Edisi Pertama.Yogyakarta : BPFE

Priyatno, Dwi .2008. Teknik Mudah dan Cepat Melakukan Analisis Data Penelitian dengan SPSS. Yogyakarta : Gava Media.

Purnomo. Ade. 2010. Pengaruh Pendapatan Pegadaian, Jumlah Nasabah, dan Tingkat Inflasi terhadap Penyaluran Kredit pada PT Pegadaian Cabang Dewi Sartika Periode 2004-2008. Universitas Gunadarma. Depok.

Putong, Iskandar, 2008, Ekonomi Mikro dan Makro, Ghalia Indonesia, Jakarta

Raharjo, Sugeng. 2009. Pengaruh Suku Bunga, Pendapatan Nasabah, Status Pekerjaan Nasabah, Jangka Waktu Kredit terhadap Jumlah Pengambilan Kredit pada Nasabah perusahaan Daerah Badan Kredit Kecamatan Eromoko Kabupaten Wonogiri. Universitas Gunadarma.

Rimsky K. Judisseno. 2005. Perpajakan (Edisi Revisi), Jakarta: PT. Gramedia Pustaka Utama.

DOI: https://doi.org/10.30872/jakt.v13i2.1175

Refbacks

- There are currently no refbacks.

Copyright (c) 2017 Ade Septevany Dewi

Editorial Address

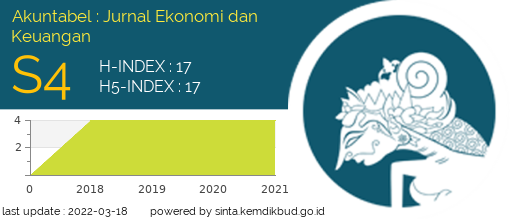

Akuntabel: Jurnal Akuntansi dan Keuangan

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jakt.feb.unmul@gmail.com

StatCounter: Akuntabel: Jurnal Akuntansi dan Keuangan