Faktor fundamental dan capital behavior perbankan di Indonesia

Abstract

Modal memiliki peran penting pada operasional perbankan, selain mengindikasikan pemenuhan regulasi modal juga berfungsi untuk mengantisipasi resiko dimasa mendatang. Studi mengenai capital buffer yang dimediasi ROA masih jarang dilakukan. Studi ini bertujuan untuk mengisi kesenjangan dengan menginvestigasi faktor penentu capital buffer dengan menggunakan path analysis penelitian dilakukan pada bank umum yang dimiliki oleh pemerintah dengan peroiode pengamatan tahun 2015 hingga tahun 2020. Adanya campur tangan terutama pada sisi pendanaan sisi pendanaan menjadi salah satu karakteristik bank persero. Hasil penelitian menunjukkan LOTA berpengaruh secara negatif terhadap ROA dan capital buffer sedangkan NPL berpengaruh secara negatif terhadap ROA dan berpengaruh secara positif terhadap capital buffer. Pada pengujian mediasi ROA mamou memediasi pengaruh NPL terhadap capital buffer namun tidak mampu memediasi engaruh LOTA terhadap capital buffer.Â

Keywords

Full Text:

PDF (Bahasa Indonesia)References

Anggitasari, Agustina Alam, and Erman Denny Arfinto. 2013. “Hubungan Simultan Antara Capital buffer Dan Risiko.â€

Antoun, Roger, Ali Coskun, and Darin Youssef. 2021. “Bank-Specific, Macroeconomic, and Institutional Factors Explaining the Capital buffer and Risk Adjustments in Banks: A Simultaneous Approach.†Eastern European Economics 59(2): 103–24. https://doi.org/10.1080/00128775.2020.1870406.

Atici, Gonca, and Guner Gursoy. 2012. “The Determinants of Capital buffer in the Turkish Banking System.†International Business Research 6(1): 224–34.

Bayuseno, Vaditra, and Mochammad Chabachib. 2014. “Determina Factors of Capital buffer Perbankan Di Indonesia ( Studi Pada Bank-Bank Konvensional Go Public Periode 2010-2013 ).†Diponegoro Journal of Management 3(4): 1–13.

Berger, Allen N, and Christa H S Bouwman. 2006. “The Measurement of Bank Liquidity Creation and the Effect of Capital.†Available at SSRN 672784.

Fauzia, Nanda Arum, and Idris. 2016. “Analisis Faktor-Faktor Yang Mempengaruhi Capital buffer (Studi Kasus Pada Bank Umum Konvensional Yang Terdaftar Di BEI Tahun 2011-2014).†Diponegoro Journal of Management 5(2): 1–12.

Firdaus, Jemmy et al. 2021. “Pengaruh Determinasi Penyaluran Kredit Terdaftar Di Bursa Efek.†6: 137–54.

Fitrianto, Hendra, and Wisnu Mawardi. 2006. “Analisis Pengaruh Kualitas Aset, Likuiditas, Rentabilitas, Dan Efisiensi Terhadap Rasio Kecukupan Modal Perbankan Yang Terdaftar Di Bursa Efek Jakarta.†Jurnal Studi Manajemen Organisasi 3(1): 1–11.

Guidara, Alaa, Van Son Lai, Issouf Soumaré, and Fulbert Tchana Tchana. 2013. “Banks’ Capital buffer, Risk and Performance in the Canadian Banking System: Impact of Business Cycles and Regulatory Changes.†Journal of Banking and Finance 37(9): 3373–87. http://dx.doi.org/10.1016/j.jbankfin.2013.05.012.

Handayani, Dewi Sri, and Bambang Sudiyatno. 2017. “Kualitas Kredit Pada Industri Perbankan Dan Dampaknya Terhadap Profitabilitas Bank.†Jurnal Bisnis dan Ekonomi 24(2): 150–61.

Haryanto, Sugeng. 2015. “Determinan Capital buffer: Kajian Empirik Industri Perbankan Nasional.†Jurnal Ekonomi MODERNISASI 11(2): 108.

Jiang, Hai, Jinyi Zhang, and Chen Sun. 2020. “How Does Capital buffer Affect Bank Risk-Taking? New Evidence from China Using Quantile Regression.†China Economic Review 60(xxxx): 101300. https://doi.org/10.1016/j.chieco.2019.04.008.

Jokipii, Terhi, and Alistair Milne. 2011. “Bank Capital buffer and Risk Adjustment Decisions.†Journal of Financial Stability 7(3): 165–78.

Latifah, N., R. Rodhiyah, and S. Saryadi. 2012. “Pengaruh Capital Adequacy Ratio (Car), Non Performing Loan (Npl) Dan Loan To Deposit Ratio (Ldr) Terhadap Return on Asset (Roa) (Studi Kasus Pada Bank Umum Swasta Nasional Devisa Go Public Di Bursa Efek Indonesia Periode 2009-2010).†Jurnal Ilmu Administrasi Bisnis S1 Undip 1(1): 57–66.

Mishkin, Frederic S. 2007. The Economics of Money, Banking, and Financial Markets. Pearson education.

Muhammad, Rizal., Abdul Rahman . Mus, and Nurnajamuddin Mahfud. 2020. “Pengaruh Debt To Equity Ratio ( DER ), Non Performing Loan ( NPL ), Loan To Deposit Ratio ( LDR ) Dan Pertumbuhan Perusahaan Terhadap Profitabilitas Pada Perusahaan Sektor Perbankan Yang Terdaftar Di Bursa Efek Indonesia Aut.†Paradoks: Jurnal Ilmu Ekonomi 3(2): 97–111.

Muin, Sri Adrianti. 2017. “Analisis Faktor-Faktor Yang Memengaruhi Rentabilitas Pada P.T. Bank Rakyat Indonesia (Persero) Tbk. Periode 2011-2016.†Jurnal Economix 5(137): 137–47.

Nitzl, Christian, and Gabriel A Cepeda-carrion. 2017. “Mediation Analyses in Partial Least Squares Structural Equation Modeling , Helping Researchers Discuss More Sophisticated Models : An Abstract.†(April).

Noreen, Umara, Fizza Alamdar, and Tabassum Tariq. 2016. “Capital buffers and Bank Risk: Empirical Study of Adjustment of Pakistani Banks.†International Journal of Economics and Financial Issues 6(4): 1798–1806.

Paolucci, Elisa Menicucci Guido. 2016. “The Determinants of Bank Profitability : Empirical Evidence from European Banking Sector Article Information : About Emerald Www.Emeraldinsight.Com.†Journal of Financial Reporting and Accounting Iss Journal of Economic Studies Journal of Economic Studies Iss Universiti Teknologi MARA At 14(May): 1–24.

Purwanti, Juni, Sudarto, and Suwaryo. 2015. “Analisis Hubungan Jangka Panjang Dan Jangka Pendek Antara NPL, ROE, SIZE Dan LOTA Terhadapa Capital buffer.†Performance 22(2): 29–48.

Purwoko & Sudityatno. 2013. “Faktor-Faktor Yang Mempengaruhi Kinerja Bank (Studi Empirik Pada Industri Perbankan Di Bursa Efek Indonesia). Jurnal Bisnis Dan Ekonomi, 20(1), 24192..Pdf.†Jurnall Bisnis dan Ekonomi 20(1): 25–39.

Sadalia, Isfenti, Hartika Ichtiani, and Novi Andrani Butar-Butar. 2017. “Analysis of Capital buffer in Indonesian Banking.†131(Icoi): 128–33.

Saeed, Sadia, and Noreen Akhter. 2012. “Impact of Macroeconomic Factors on Banking Index in Pakistan.†Interdisciplinary Journal of Contemporary Research in Business 4(6): 1200–1218.

Seenaiah, K, Badri Narayan Rath, and Amaresh Samantaraya. 2015. “Determinants of Bank Profitability in the Post-Reform Period: Evidence from India.†Global Business Review 16(5_suppl): 82S-92S.

Shim, Jeungbo. 2013. “Bank Capital buffer and Portfolio Risk: The Influence of Business Cycle and Revenue Diversification.†Journal of Banking and Finance 37(3): 761–72. http://dx.doi.org/10.1016/j.jbankfin.2012.10.002.

Tabak, Bm, Ac Noronha, and Daniel Cajueiro. 2011. “Bank Capital buffers, Lending Growth and Economic Cycle: Empirical Evidence for Brazil.†Bank for internacional settlements (5): 1–20. https://www.bis.org/events/ccaconf2011/tabak.pdf.

Tasman, Abel. 2020. “Jurnal Inovasi Pendidikan Ekonomi Capital buffer Dan Faktor Penentunya Di Indonesia.†: 132–43.

Utami, Dwi, Edi Budi Santoso, and Ari Pranaditya. 2017. “Pengaruh Struktur Modal, Pertumbuhan Perusahaan, Profitabilitas, Ukuran Perusahaan, Kinerja Keuangan Perusahaan, Terhadap Nilai Perusahaan (Studi Kasus Perusahaan Manufaktur Sektor Aneka Industri Yang Terdaftar Di Bursa Efek Indonesia Tahun 2011-2015.†Jurnal Ilmiah Akuntansi 3(3): 1–20.

Wong, Jim, Ka-fai Choi, and Tom Pak-Wing Fong. 2008. “Determinants of the Capital Level of Banks in Hong Kong.†In The Banking Sector in Hong Kong, Springer, 159–90.

WU, Cheng-song, Kai-chun Guo, Hui XU, and Song-qin Huang. 2016. “Cyclical Behavior Study of Capital buffer Based on the Evidence of City Commercial Bank.†Scientific Decision Making: 7.

DOI: https://doi.org/10.30872/jkin.v19i3.11381

Refbacks

- There are currently no refbacks.

Copyright (c) 2022 Dhurotus Sangadah

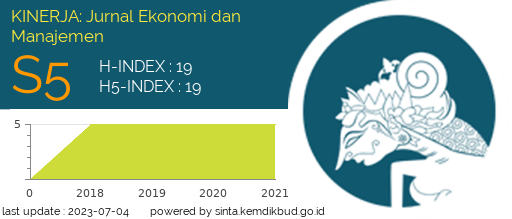

Kinerja: Jurnal Ekonomi dan Manajemen

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jkin.feb.unmul@gmail.com

StatCounter: Kinerja