Pengaruh leverage, price to book value dan return on assets terhadap earnings management pada perusahaan manufaktur industri bahan dasar dan kimia sub sektor logam yang terdaftar di bursa efek indonesia

Abstract

Keywords

Full Text:

PDF (Bahasa Indonesia)References

Abarbanell, J., & Lehavy, R. (2003). Can stock recommendations predict earnings management andanalysts’ earnings forecast errors? Journal of Accounting Research, 41(1), 1–31. https://doi.org/10.1111/1475-679X.00093

Agnes Cheng, C. S. (2013). The supplemental role of operating cash flows in explaining share returns: Effect of various measures of earnings quality. International Journal of Accounting and Information Management, 21(1), 53–71. https://doi.org/10.1108/18347641311299740

Akram, M. A. (2015). Earnings management and organizational performance: Pakistan VS India. Basic Research Journal of Business Management and Accounts, 4(9), 211–220.

Alves, S. (2012). Ownership structure and earnings management Evidence from Portug. Australian Accounting Business and Finance Journal, 6(1), 57–74. https://doi.org/10.5539/ijbm.v7n15p88

Bartov, E., Gul, F. A., & Tsui, J. S. L. (2001). Discretionary-Accruals Models and Audit Qualifications. Journal of Accounting and Economics, 39, 421–452.

Beaver, G. (2002). Strategy and management in the smaller enterprise. Strategic Change, 11(4), 175–181. https://doi.org/10.1002/jsc.591

Beneish, M. D. (1999). The Detecton of Earnings Manipulation. Financial Analysts Journal, 55(5), 24–35.

Caplan, D. H., Dutta, S. K., & Marcinko, D. J. (2012). Lehman on the brink of bankruptcy: A case about aggressive application of accounting standards. Issues in Accounting Education, 27(2), 441–459. https://doi.org/10.2308/iace-50126

Chen, G. (2006). Ownership structure , corporate governance , and fraud : Evidence from China. Journal of Corporate Finance, 12, 424–448. https://doi.org/10.1016/j.jcorpfin.2005.09.002

Copeland, R. M. (1968). Accounting Research Center, Booth School of Business, University of Chicago. Journal of Accounting Research, 6, 101–116.

Dechow, P. M., & Skinner, D. J. (2000). Earnings Management : Reconciling the Views of Accounting Academics , Practitioners , and Regulators. Accounting Hporizons, 14(2), 235–250.

DeFond, M. L., & Jiambalvo, J. (1994). Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics, 17, 145–176. https://doi.org/10.1016/0165-4101(94)90008-6

Degeorge, F., Patel, J., & Zeckhauser, R. (1999). Earnings Management to Exceed Thresholds. The Journal of Business, 72(1), 1–33. https://doi.org/10.1086/209601

Dichev, I. D., & Skinner, D. J. (2002). Large-Sample Evidence on the Debt Covenant Hypothesis. Journal of Accounting Research, 40(4).

Erickson, M., & Wang, S. W. (1996). Earnings management by acquiring firms in stock for stock mergers. Journal of Accounting and Economics, 27(2), 149–176. https://doi.org/10.1016/S0165-4101(99)00008-7

Feldman, D. C., & Leana, C. R. (1994). Better Practices in Managing Layoffs, 33(2), 239–260.

Freeman, R. E., & Reed, D. L. (1983). In vitro as sess ment of antimicrobial potency and synergistic effects of three medicinal plants’ (Mentha arvensis, Carissa carandas and Calendula officinalis) extract against pathogenic bacteria Bharti. California Management Review, 25(3), 88. https://doi.org/10.5897/A

Freeman, R. edward. (2004). Stakeholder Theory and “ The Corporate Objective Revisited .†Organization Science, 15(3), 364–369. https://doi.org/10.1287/orsc.1040.0066

Healy, P. M. (1985). THE EFFECT OF BONUS SCHEMES ON ACCOUNTING DECISIONS* Paul M. HEALY. Journal of Accounting and Economics, 7, 85–107.

Healy, P. M., & Wahlen, J. M. (1999). A Review of the Earnings Management Literature and Its. Accounting Horizons, 13(4), 365–383. https://doi.org/10.2308/acch.1999.13.4.365

Hendryadi, H., Tricahyadinata, I., & Zannati, R. (2019). Metode Penelitian: Pedoman Penelitian Bisnis dan Akademik. Jakarta: LPMP Imperium.Jones, J. J. (1991). Earnings Management During Import Relief Investigations. Journal of Accounting Research, 29(2), 193–228.

Kacharava, A. (2016). Impact of Financial Crisis on Earnings Management in Listed Companies of Portugal and UK Master in International Business Impact of Financial Crisis on Earnings Management in Listed Companies of Portugal and UK. Dissertation Master in International Business, 5, 1–60.

Khurana, I. K. (2004). Litigation Risk and the Financial Reporting Credibility of Big 4 versus Non-Big 4 Audits : Evidence from Anglo-American Countries. The Accounting Review, 79(2), 473–495.

Kothari, S. P., Leone, A. J., & Wasley, C. E. (2002). Performance Matched Discretionary Accrual Measures. Journal of Accounting and Eco-Nomics, 39(1), 1–43.

Lambert, V. A. (2001). Literature review of role stress/strain on nurses: An international perspective. Nursing and Health Sciences, 3(3), 161–172. https://doi.org/10.1046/j.1442-2018.2001.00086.x

Lee, R. E., & Feldman, J. D. (1994). Financial Distress and Corporate Performance. The Journal of Finance, 49(3), 1015–1040.

Leuz, C., Nanda, D., & Wysocki, P. D. (2003). Earnings management and investor protection : an international comparison $. Journal of Financial Economics, 69, 505–527. https://doi.org/10.1016/S0304-405X(03)00121-1

Meissner, C. A., & Brigham, J. C. (2001). Thirty Years of Investigating the Own-Race Bias in Memory for Faces A Meta-Analytic Review. Psychology Public Policy and Law, 7(1), 3–35. https://doi.org/10.1037//1076-8971.7.1.3

Nissim, D., & Penman, S. H. (2003). Financial Statement Analysis of Leverage and How It Informs About Probability and Price-to-Book Ratio. Review of Accounting Studies, 8, 531–560. https://doi.org/10.1017/CBO9781107415324.004

Orens, R. (2009). Intellectual capital disclosure , cost of finance and firm value. The Current Issue and Full Text Archive of This Journal Is Available At, 47(10), 1536–1554. https://doi.org/10.1108/00251740911004673

Peasnell, K. V., Pope, P. F., & Young, S. (2000). Detecting earnings management using cross-sectional abnormal accruals models. Accounting and Business Research, 30(4), 313–326. https://doi.org/10.1080/00014788.2000.9728949

Perry, S. E., & Williams, T. H. (1994). Accounting & Economics preceding management buyout. Journal of Accounting & Economics, 18, 157–179.

Press, E. G., & Weintrop, J. B. (1990). Accounting-based constraints in public and private debt agreements. Their association with leverage and impact on accounting choice. Journal of Accounting and Economics, 12(1–3), 65–95. https://doi.org/10.1016/0165-4101(90)90042-3

Roychowdhury, S. (2006). Earnings management through real activities manipulation and corporate governance mechanism model. Journal of Accounting and Economics, 42, 335–370. https://doi.org/10.1016/j.jacceco.2006.01.002

Scott, A. J. (2006). Creative cities: Conceptual Issues and Policy Questions. Journal of Urban Affairs, 28(1), 1–17. https://doi.org/10.1111/j.0735-2166.2006.00256.x

Scott, C. (2000). Accountability in the Regulatory State. Journal Of Law And Society, 27(1), 38–60.

Sloan, R. G. (1996). Information in Accruals and Cash Flows About Future Earnings? The Accounting Review, 71(3), 289–315. https://doi.org/10.1023/A:1007981818860

Smith, C. W., & Watts, R. L. (1992). Metodologi Penelitian Bisnis. Yogyakarta: BPFE. Journal of Financial Economics, 32, 263–292.

Sweeney, A. P. (1994). Textbookofelectr00Arrhuoft.Pdf. Journal of Accounting and Economics, 17, 281–308. https://doi.org/10.1016/0165-4101(94)90030-2

Wong, T. J., & Rao, G. R. (1998). Are-the-Accruals-During-and-Initial-Public-Offering-Opportunistic. Review of Accounting Studies, 3, 175–208.

Yudaruddin, R. (2014). Statistik Ekonomi: Aplikasi Dengan Program SPSS Versi 20. Interpena: Yogyakarta.

DOI: https://doi.org/10.30872/jkin.v18i1.9343

Refbacks

- There are currently no refbacks.

Copyright (c) 2021 Siti Mariam, Irsan Tricahyadinata, Muhammad Amin Kadafi

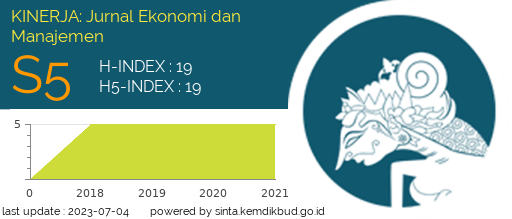

Kinerja: Jurnal Ekonomi dan Manajemen

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jkin.feb.unmul@gmail.com

StatCounter: Kinerja