Anteseden perilaku nasabah pt bankaltimtara dalam minat menggunakan layanan sms banking

Abstract

SMS banking merupakan implementasi dari teknologi mobile pada bank. Penggunaan SMS banking telah populer di dunia termasuk negara Indonesia. Salah satu faktor yang legih penting dalam penggunaan teknologi informasi termasuk SMS banking adalah niat perilaku konsumen dalam menggunakan teknologi yang telahd disediakan.TAM (Technology Acceptance Model) adalah salah satu teori yang terkenal dengan perilaku konsumen dalam menggunakan atau mengadopsi teknologi. Didalam TAM (Technology Acceptance Model) menjelaskan bahwa perceived usefulness, perceived ease of use dan attitude toward behavior merupakan variabel yang mempengaruhi behavioral intention seseorang untuk menggunakan suatu teknologi informasi. Fokus dari penelitian ini adalah untuk menguji variabel-variabel yang ada pada TAM (Technology Acceptance Model) dengan menambahkan dua variabel lainnya yaitu perceived risk dan trust. Penelitian ini menggunakan sampel sebanyak 161 responden yaitu nasabah pengguna layanan SMS banking PT Bank Pembangunan Daerah Kalimantan Timur dan Kalimantan Utara. Model penelitian dan hipotesis diuji dengan menggunakan alat analisis Structural Equation Modeling (SEM). Penelitian ini berhasil membuktikan bahwa model penelitian diterima. Penelitian ini menunjukkan hasil bahwa sembilan dari sebelas hipotesis terbukti diterima dengan tingkat signifikansi 0,01. Hasil penelitian menunjukkan bahwa variabel perceived usefulness dan perceived risk berpengaruh positif signifikan terhadap attitude toward behavior, trust dan behavioral intention. Hasil penelitian juga menemukan bahwa perceived risk berpengaruh negatif signifikan terhadap attitude toward behavior dan trust. Attitude toward behavior berpengaruh positif signifikan terhadap behavioral intention, namun perceived rist dan trust memiliki pengaruh tidak signifikan terhadap behavioral intention.

Keywords

Full Text:

PDF (Bahasa Indonesia)References

Abadi, Hossein Rezaie Dolat et al. 2012. "Investigate the customer's behavioral intention to use mobile banking based on TPB, TAM and Perceived risk (A Case Study in Meli Bank)"

Ajzen, I., (1991) "The Theory of Planned Behavior", Organizational Behavior and Human Decision Processes, 50 : 179-211.

Ajzen, I. dan Fishbein, M. 1975. Understanding Attitudes and Predicting Social Behavior. Prentice-hall, Englewood Cliffs, NJ.

Alter, S. (1992). Information System: A Management Perspective. The Benjamin/Cummings Publishing Company, Inc.

Chin, W. W. dan P. A. Todd, (1995), "On the Use, Usefulness, and Ease of Use of Structural Equation Modeling in MIS Research : A Note of Caution", MIS Quarterly, 19: 237-246

Curran, James M. dan Meuter, Matthew L., 2005. "Self-Service Technology Adoption : Comparing Three Technologies,"Journal of Service Marketing.

Davis, Fred D. 1989. Perceived Usefulness, Perceived ease of use of Information Technology. Management Information System Quarterly, 21 (3)

Gefen, D., D. W. Straub, et al. 2000. "Structural Equation Modeling and Regression Guidenlines for Research Practice." Communications of the Association to Information System 4 (7)

Giovannini, Cristiane Junqueira dan Ferreira, Jorge Brantes, 2014. "The Effects of Trust Transference, Mobile Attributes and Enjoyment on Mobile Trust"

Hassanein, Khaled dan Head, Milena, a2004. "The Influece of Product Type on Online Trust"

Hallegatte, Damien dan Nantel, Jacques. "The intertwined effecxt of perceived usefulness, perceived eaase of use and trust in a website on the intention to return"

Kesharwani, Ankit dan Bisht, Shailendra Singh., 2011. "The Impact of Trust and Perceived Risk on Internet Banking Adoption in India : An Extension of Technology Acceptance Model."

Kim, Jaejon et al. 2007. "The Effects of Trust on the Intention of Adopting Buseiness Process Outsourcing : An Empirical Study"

Khurshid, Azam et al. 2014. "Factors contributing towards adoption of E-banking in Pakistan"

Lee, Ki Soon et al. 2007. "Factors Influencing teh Adoption Behavior of Mobile Banking : A South Korean Perspective," Journal of Internet Banking and Commerce.

Lee, Thae Min, 2005. "The Impact of Perception of Interactivity on Customer Trust and Transaction Intentions in Mobile Commerce," Journal of Electronic Commerce Research Vol. 6 No. 3

Lin, Jiun-Shen Chris dan Chang, Hsing-Chi. 2011. "The Role of Technology Readiness in Self-Service Technology Acceptance"

Ling, Kwek Choon et al. 2011. "Perceived Risk, Perceived Technology, Online Trust for the Online Purchase Intention in Malaysia"

Lucas, H.C. (1999) Information Technology for Management. 7th Edition. New York McGraw-Hill

Maroofi, Fakhradding et al. 2013. "An investigation of initial turst in mobile banking"

Mathieson, K., (1991), "Predicting User Intentions : Comparing the Technology Acceptance Model with the Theory of Planned Behavior", Information Systems Research, 2 : 173-191.

Mayer, R.C., Davis, J. H., dan Schoorman, F. D. (1995). An Integratif Model of Organizational Trust. Academy of Management Review. 30 (3) : 709-734.

Rousseau, D.M., S.B. Sitkin, R.S. Burt, and C. Camerer. 1998. Not So Different After All : A Cross-Discipline View of Trust. Academy of Management Review 23:393-404.

Salmanraju, P. and Rakesh, A. "The Interrelationships among trust, perceived risk and behavioral intention for technology acceptance and internet banking"

Stanton, William J.1996. Prinsip Pemasaran (terjemahan). Edisi7,jilid 1.Erlangga. Jakarta

Suh, Bomil dan Han, Ingoo,. 2002. "Effect of Trust on Customer Acceptance of Internet Banking"

Thompson, Ronald L, Haggings, Christoper A., dan Howell, Jane M. (1991), "Personal Comuting : Toward a Conceptual Model of Utilization", Mis Quarterly, pp. 125-143.

Thomposn, Ronald L., 1994. Higgins, christopher A., dan Howwel, Jane M., "Influence of Experience on Personal Computer Utilization : Testing A conceptual Model," Journal of Management Information System.

Yousafzai, Shumaila dan Soriano, Mirelia Yani de,. 2011. "Understanding Customer-Specific Factors Underpinning Internet Banking Adoption".

DOI: https://doi.org/10.30872/jkin.v16i2.6277

Refbacks

- There are currently no refbacks.

Copyright (c) 2019 Heni Rahayu Rahmawati, Sugeng Hariyadi

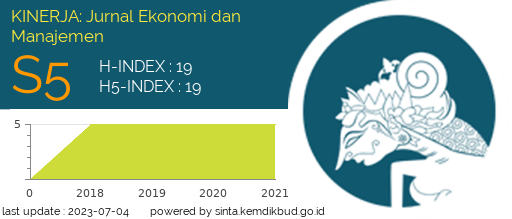

Kinerja: Jurnal Ekonomi dan Manajemen

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jkin.feb.unmul@gmail.com

StatCounter: Kinerja