Faktor penentu yang mempengaruhi penggunaan layanan internet banking

Abstract

This study aims to analysis the important factor that influence the use of internet banking according to Booklet Perbankan Indonesia 2016 and the implication for the marketing of internet banking services. Security has become a determining factor which affecting the use of internet banking services. It is important for the bank to find out how to maintain the customers who have used the internet banking services in order to encounter competition with a variety of banking services distribution channels innovation. This research used purposive and snow ball sampling. Data collection is done by distributing questionnaires to individual users of internet banking in Indonesia. The results showed that security as the important determining factors that influence to use internet banking, while auxiliary features do not.

Keywords: Internet banking, Consumer behavior, Security, Auxiliary features.

Full Text:

PDFReferences

Akinci, S., Aksoy, S. & Atilgan, E., 2004. Adoption of Internet banking among sophisticated consumer segments in an advanced developing country. International Journal of Bank Marketing, 22(MAY 2004), pp.212–232.

Davis, F.D., 1989. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly, 13(3), p.319. Available at: https://www.jstor.org/stable/249008nhttp://www.jstor.org/stable/249008?origin=crossref.

Direktorat Penelitian dan Pengaturan Perbankan Bank Indonesia. 2002. Internet Banking di Indonesia. http://journalbankindonesia.org/index.php/BEMP/article/download/304/281 (diunduh tanggal 10 Agustus 2016).

Grabner-Kräuter, S. & Faullant, R., 2008. Consumer acceptance of internet banking: the influence of internet trust. International Journal of Bank Marketing, 26(7), pp.483–504.

Kontan.co.id. 2015. Jumlah Bank di Indonesia masih 118. http://keuangan.kontan.co.id/news/2015-jumlah-bank-di-indonesia-masih-118 (diakses tanggal 10 Agustus 2016)

Kotler, P. & Kevin, L.K., 2016. Marketing Management Global Edition, 15th ed, Upper Saddle River: Pearson Educated Limited.

Laforet, S. & Li, X., 2005. Consumers’ attitudes towards online and mobile banking in China. International Journal of Bank Marketing, 23(5), pp.362–380.

Maditinos, D., Chatzoudes, D. & Sarigiannidis, L., 2013. An examination of the critical factors affecting consumer acceptance of online banking: A focus on the dimensions of risk. Journal of Systems and Information Technology, 15(1), pp.97–116. Available at: http://www.emeraldinsight.com/10.1108/13287261311322602.

Mäenpää, K., 2006. Clustering the consumers on the basis of their perceptions of the Internet banking services. Internet Research, 16(3), pp.304–322.

Mäenpää, K. et al., 2008. Consumer perceptions of Internet banking in Finland: The moderating role of familiarity. Journal of Retailing and Consumer Services, 15(4), pp.266–276.

Mathwick, C., Malhotra, N. & Rigdon, E., 2001. Experiential value: Conceptualization, measurement and application in the catalog and Internet shopping environment. Journal of Retailing, 77(1), pp.39–56.

Mukherjee, A. & Nath, P., 2003. A model of trust in online relationship banking. International Journal of Bank Marketing, 21, pp.5–15.

Otoritas Jasa Keuangan. 2015. Bijak Ber-eBanking. http://www.ojk.go.id/Files/201509/BukuBijakBereBanking_1441890913.pdf. (diunduh tanggal 10 Agustus 2016).

Otoritas Jasa Keuangan. 2016. Booklet Perbankan Indonesia. http://www.ojk.go.id/id/kanal/perbankan/data-dan-statistik/booklet-perbankan-indonesia/Documents/Pages/Booklet-Perbankan-Indonesia-2016/Booklet%20Perbankan%20Indonesia%202016.pdf (diunduh tanggal 10 Agustus 2016).

Ozdemir, S., Trott, P. & Hoecht, a., 2008. Segmenting internet banking adopter and non-adopters in the Turkish retail banking sector. International Journal of Bank Marketing, 26(4), pp.212–236.

Pikkarainen, T. et al., 2004. Consumer acceptance of online banking: an extension of the technology acceptance model. Internet Research, 14(3), pp.224–235. Available at: http://www.emeraldinsight.com/10.1108/10662240410542652nhttp://www.emeraldinsight.com/case_studies.htm/journals.htm?articleid=863805&show=html&WT.mc_id=alsoread.

Sathye, M., 1999. Adoption of Internet banking by Australian consumers: an empirical investigation. International Journal of Bank Marketing, 17(7), pp.324–334. Available at: http://www.emeraldinsight.com.ezproxy1.library.usyd.edu.au/doi/abs/10.1108/02652329910305689.

Schiffman, L. & Leslie, L.K. 2008. Perilaku Konsumen. Edisi Ketujuh. Jakarta:Indeks.

Susanto, A. et al., 2013. User acceptance of Internet banking in Indonesia: initial trust formation. Information Development, 29(4), pp.309–322. Available at: http://idv.sagepub.com/cgi/doi/10.1177/0266666912467449.

Waite, K. & Harrison, T., 2004. Online banking information: what we want and what we get. Qualitative Market Research: An International Journal, 7(1), pp.67–79.

Wang, Y.-S. et al., 2003. Determinants of user acceptance of Internet banking: an empirical study. International Journal of Service Industry Management, 14(5), pp.501–519.

DOI: https://doi.org/10.30872/jkin.v13i1.322

Refbacks

- There are currently no refbacks.

Copyright (c) 2016 Ellen Theresia Sihotang

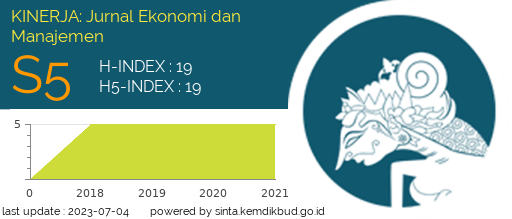

Kinerja: Jurnal Ekonomi dan Manajemen

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jkin.feb.unmul@gmail.com

StatCounter: Kinerja