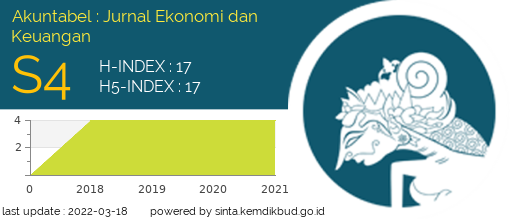

Does family firm have better performance? empirical research in indonesia smes

Abstract

Small and Medium Enterprises (SMEs) have an essential and strategic role in national economic development. SMEs are proven to be resistant to the financial crisis and absorb part of the workforce in Indonesia. This study examines whether SMEs family firm and diversification have better performance. The research sample was 114 SMEs owners in the Special Region of Yogyakarta. The results of the study prove that SMEs family firm and SMEs that diversify have better performance. The results of this study are expected to provide advice to SMEs owners that family businesses can be expanded through diversification to increase business value.

Keywords

Full Text:

PDFReferences

Anderson, R. C., & Reeb, D. M. (2003). Founding‐family ownership and firm performance: evidence from the S&P 500. The journal of finance, 58(3), 1301-1328.

Anita, A., Kirmizi, K., & Savitri, E. (2018). Pengaruh family ownership terhadap kinerja keuangan: strategi bisnis dan agency cost sebagai variabel moderating. Jurnal Ekonomi, 24(4), 1.

Ardiana, I., Brahmayanti, I., & Subaedi, S. (2010). Kompetensi SDM UKM dan pengaruhnya terhadap kinerja UKM di Surabaya. Jurnal manajemen dan Kewirausahaan, 12(1), 42-55.

Baptista, R., Karaöz, M., & Leitão, J. (2012). Diversification and Survival of Young, Small Firms. Small Firms (February 23, 2012).

Barbera, F., & Moores, K. (2013). Firm ownership and productivity: a study of family and non-family SMEs. Small Business Economics, 40(4), 953-976.

Budiarto, D. S., Prabowo, M. A., & Herawan, T. (2017). An integrated information system to support supply chain management & performance in SMEs. Journal of Industrial Engineering and Management (JIEM), 10(2), 373-387.

Cahyani, K. A., & Sanjaya, I. P. S. (2017). Analisis Perbedaan Dividen Pada Perusahaan Keluarga dan Non Keluarga Berdasarkan Kepemilikan Ultimat. Modus Journals, 26(2), 133-144.

Carnes, C. M., Xu, K., Sirmon, D. G., & Karadag, R. (2019). How Competitive Action Mediates the Resource Slack–Performance Relationship: A Meta‐Analytic Approach. Journal of Management Studies, 56(1), 57-90.

Chang, S.-I., Yen, D. C., Ng, C. S.-P., & Chang, W.-T. (2012). An analysis of IT/IS outsourcing provider selection for small-and medium-sized enterprises in Taiwan. Information & suManagement, 49(5), 199-209.

Choi, J.-D., Lee, J.-S., & Bae, Z.-T. (2019). When do firms focus on public research?: evidence from US medical device industry. Industry and Innovation, 1-23.

Chu, W. (2009). The influence of family ownership on SME performance: evidence from public firms in Taiwan. Small Business Economics, 33(3), 353-373.

De Pontet, S. B., Aronoff, C. E., Mendoza, D. S., & Ward, J. L. (2012). Siblings and the family business: Making it work for business, the family, and the future: Palgrave Macmillan.

Delbufalo, E., Poggesi, S., & Borra, S. (2016). Diversification, family involvement and firm performance: empirical evidence from Italian manufacturing firms. Journal of Management Development, 35(5), 663-680.

Dubihlela, J., & Rundora, R. (2014). Employee training, managerial commitment and the implementation of activity based costing; Impact on performance of SMEs. The International Business & Economics Research Journal (Online), 13(1), 27.

Ediraras, D. T. (2011). Akuntansi dan Kinerja UKM. Jurnal Ilmiah Ekonomi Bisnis, 15(2).

Ghozali, I. (2018). Aplikasi analisis multivariete dengan program IBM SPSS 23.

Gozali, J. (2014). Analisa Kinerja Bisnis Aspek Pemasaran dan Sumber Daya Manusia pada Perusahaan Keluarga dan Perusahaan Non Keluarga di Jawa Timur. Agora, 2(2), 1419-1424.

Hamid, E. S., & Susilo, Y. (2011). Strategi pengembangan usaha mikro kecil dan menengah di Provinsi Daerah Istimewa Yogyakarta.

Hann, R. N., Ogneva, M., & Ozbas, O. (2013). Corporate diversification and the cost of capital. The journal of finance, 68(5), 1961-1999.

Ismail, N. A., & King, M. (2014). Factors influencing the alignment of accounting information systems in small and medium sized Malaysian manufacturing firms. Journal of Information Systems and Small Business, 1(1-2), 1-20.

Keh, H. T., Nguyen, T. T. M., & Ng, H. P. (2007). The effects of entrepreneurial orientation and marketing information on the performance of SMEs. Journal of business venturing, 22(4), 592-611.

Kim, Y., & Gao, F. Y. (2013). Does family involvement increase business performance? Family-longevity goals’ moderating role in Chinese family firms. Journal of Business Research, 66(2), 265-274.

Kraus, S., Pohjola, M., & Koponen, A. (2012). Innovation in family firms: an empirical analysis linking organizational and managerial innovation to corporate success. Review of Managerial Science, 6(3), 265-286.

Kurniasari, S. E., & Tahun, E. T. (2013). Pengaruh Diversifikasi Usaha Terhadap Kinerja Perusahaan Yang Dimoderasi Oleh Kepemilikan Manajerial. Semarang: Universitas Dian Nuswantoro.

Lucyanda, J., & Wardhani, R. H. K. (2017). Pengaruh diversifikasi dan karakteristik perusahaan terhadap kinerja perusahaan. Media Riset Akuntansi, 4(2), Hal. 1-23.

Lukiastuti, F. (2012). Pengaruh orientasi wirausaha dan kapabilitas jejaring usaha terhadap peningkatan kinerja ukm dengan komitmen perilaku sebagai variabel interviening (Studi empiris pada sentra UKM batik di Sragen, Jawa Tengah). Jurnal Organisasi dan Manajemen, 8(2), 155-175.

McKague, K., D. Wheeler, C. Cash, J. Comeault, E. Ray, and Tahi Hamonangan Tambunan. 2011. Development of small and medium enterprises in a developing country: The Indonesian case. Journal of Enterprising Communities: People and Places in Global Economy 5 (1): 68-82.

Morck, R., & Yeung, B. (2004). Special issues relating to corporate governance and family control: The World Bank.

Muñoz-Bullón, F., & Sanchez-Bueno, M. J. (2011). Is there new evidence to show that product and international diversification influence SMEs' performance? EuroMed Journal of Business, 6(1), 63-76.

Naranjo-Valencia, J. C., Calderón-Hernández, G., Jiménez-Jiménez, D., & Sanz-Valle, R. (2018). Entrepreneurship and innovation: Evidence in colombian SMEs Handbook of Research on Intrapreneurship and Organizational Sustainability in SMEs (pp. 294-316): IGI Global.

Pangboonyanon, V., & Kalasin, K. (2018). The impact of within-industry diversification on firm performance: Empirical evidence from emerging ASEAN SMEs. International Journal of Emerging Markets, 13(6), 1475-1501.

Purnomo, R., & Lestari, S. (2010). Pengaruh kepribadian, self-efficacy, dan locus of control terhadap persepsi kinerja usaha skala kecil dan menengah. Jurnal Bisnis dan Ekonomi, 17(2).

Radzi, K. M., Nor, M. N. M., & Ali, S. M. (2017). The Impact of Internal Factors on Small Business Success: A Case of Small Enterprises Under the Felda Scheme. Asian Academy of Management Journal, 22(1), 27.

Sari, M. (2014). Enterpreneur terhadap Kinerja UKM di Kota Medan. Jurnal Riset Akuntansi Dan Bisnis, 14(1).

Shen, N., Au, K., & Yi, L. (2018). Diversification Strategy, Ownership Structure, and Financial Crisis: Performance of Chinese Private Firms. Asia‐Pacific Journal of Financial Studies, 47(1), 54-80.

Simanjuntak, A. (2011). Prinsip-prinsip manajemen bisnis keluarga (family business) dikaitkan dengan kedudukan mandiri perseroan terbatas (PT). Jurnal manajemen dan Kewirausahaan, 12(2), 113-120.

Suci, Y. R. (2017). Perkembangan UMKM (Usaha mikro kecil dan menengah) di Indonesia. Cano Ekonomos, 6(1), 51-58.

Sumendap, R., Tommy, P., & Maramis, J. B. (2018). Analisis perbandingan kinerja keuangan berdasarkan diversifikasi segmen bisnis pada industri manufaktur yang go public. Jurnal EMBA: Jurnal Riset Ekonomi, Manajemen, Bisnis dan Akuntansi, 6(4).

Sunarjanto, N. A., Roida, H. Y., & Christiana, A. (2013). Analysis of the internationalization strategy of the engagement and ownership of family in east java with variable control of innovation, sales, and assets: Review of agency theory. Sustainable Competitive Advantage (SCA), 2(1).

Tahi Hamonangan Tambunan, T. (2011). Development of small and medium enterprises in a developing country: The Indonesian case. Journal of Enterprising Communities: People and Places in the Global Economy, 5(1), 68-82.

Tjantoko, L. E. (2014). Hubungan Sumber Keuangan dan Budaya Bisnis Keluarga dengan Inovasi Produk. Agora, 2(2), 1489-1493.

Weng, T.-C., & Chi, H.-Y. (2019). Family succession and business diversification: Evidence from China. Pacific-Basin Finance Journal, 53, 56-81.

DOI: https://doi.org/10.30872/jakt.v16i2.6145

Refbacks

- There are currently no refbacks.

Copyright (c) 2019 Ratna Purnama Sari, Shinta Suryaningrum, Dekeng Setyo Budiarto

Editorial Address

Akuntabel: Jurnal Akuntansi dan Keuangan

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jakt.feb.unmul@gmail.com

StatCounter: Akuntabel: Jurnal Akuntansi dan Keuangan