Perbedaan faktor yang mempengaruhi trust dalam penggunaan e-banking berdasarkan gender

Abstract

Penelitian ini bertujuan untuk mengetahui perbedaan faktor yang mempengaruhi trust atau kepercayaan dalam penggunaan e-banking berdasarkan gender terhadap 203 responden. Responden adalah pengguna e-banking dengan patokan usia produktif yaitu antara 15-64 tahun. Teknik analisis yang digunakan adalah SEM-PLS dan data diolah dengan software WarpPLS 6.0. Beberapa temuan dalam penelitian ini adalah bahwa task characteristic merupakan faktor yang paling signifikan dalam mempengaruhi trust baik bagi laki-laki maupun perempuan. Variabel kedua yang berpengaruh terhadap kepercayaan dalam menggunakan e-banking adalah risk perceived bagi perempuan dan social influences bagi laki-laki. Karakteristik tugas sebagai faktor utama yang berpengaruh terhadap kepercayaan dalam menggunakan e-banking sesuai dengan sampel penel Hal ini sesuai dengan profil sampel yang diperoleh yaitu pada usia. Sampel dalam penelitian ini adalah individu dalam rentang usia produktif yang membutuhkan teknologi e-banking dalam menjalankan aktivitas harian, utamanya untuk mengelola keuangan mereka secara cepat dan mudah.

Keywords

Full Text:

PDF (Bahasa Indonesia)References

Agarwal, R., & Karahanna, E. (2000). Time flies when you're having fun: Cognitive absorption and beliefs about information technology usage. MIS quarterly, 665-694.

Al-Gahtani, S. S. (2011). Modeling the electronic transactions acceptance using an extended technology acceptance model. Applied computing and informatics, 9(1), 47-77.

Al-Jabri, I. M., & Sohail, M. S. (2012). Mobile banking adoption: Application of diffusion of innovation theory. Journal of Electronic Commerce Research, 13(4), 379-391.

Baptista, G., & Oliveira, T. (2015). Understanding mobile banking: The unified theory of acceptance and use of technology combined with cultural moderators. Computers in Human Behavior, 50, 418-430.

Coates, J. M., & Herbert, J. (2008). Endogenous steroids and financial risk taking on a London trading floor. Proceedings of the national academy of sciences, 105(16), 6167-6172.

Cruz, P., Barretto Filgueiras Neto, L., Munoz-Gallego, P., & Laukkanen, T. (2010). Mobile banking rollout in emerging markets: evidence from Brazil. International Journal of Bank Marketing, 28(5), 342-371.

Goh, T.-T., & Sun, S. (2014). Exploring gender differences in Islamic mobile banking acceptance. Electronic Commerce Research, 14(4), 435-458.

Goodhue, D. L., & Thompson, R. L. (1995). Task-technology fit and individual performance. MIS quarterly, 213-236.

Hwang, Y., & Jeong, J. (2014). Electronic commerce and online consumer behavior research: A literature review. Information Development, 32(3), 377-388.

Instone, D., Major, B., & Bunker, B. B. (1983). Gender, self confidence, and social influence strategies: An organizational simulation. Journal of Personality and Social Psychology, 44(2), 322-333. doi: 10.1037/0022-3514.44.2.322

Kumparan. (2019). Tergilas digitalisasi, ribuan kantor cabang bank tutup Retrieved 5 Mei, 2019, from https://kumparan.com/kabarbisnis/tergilas-digitalisasi-ribuan-kantor-cabang-bank-tutup-1qwrkMghTXN

Laforet, S., & Li, X. (2005). Consumers’ attitudes towards online and mobile banking in China. International Journal of Bank Marketing, 23(5), 362-380.

Lee, C.-C., Cheng, H. K., & Cheng, H.-H. (2007). An empirical study of mobile commerce in insurance industry: Task–technology fit and individual differences. Decision support systems, 43(1), 95-110.

Li, Y.-M., & Yeh, Y.-S. (2010). Increasing trust in mobile commerce through design aesthetics. Computers in Human Behavior, 26(4), 673-684.

Liao, C., Liu, C.-C., & Chen, K. (2011). Examining the impact of privacy, trust and risk perceptions beyond monetary transactions: An integrated model. Electronic Commerce Research and Applications, 10(6), 702-715.

Lu, J., Yao, J. E., & Yu, C.-S. (2005). Personal innovativeness, social influences and adoption of wireless Internet services via mobile technology. The Journal of Strategic Information Systems, 14(3), 245-268.

Malaquias, R. F., & Hwang, Y. (2016). An empirical study on trust in mobile banking: A developing country perspective. Computers in Human Behavior, 54, 453-461.

McKnight, D. H., Choudhury, V., & Kacmar, C. (2002). Developing and validating trust measures for e-commerce: An integrative typology. Information systems research, 13(3), 334-359.

Mohammadi, H. (2015). A study of mobile banking loyalty in Iran. Computers in Human Behavior, 44, 35-47.

Moss, G. (1999). Gender and consumer behaviour: Further explorations. Journal of Brand Management, 7(2), 88-100.

OJK. (2017). Siaran Pers : Ojk Terbitkan Panduan Penyelenggaraan Kantor Digital Wujudkan Perbankan Digital Di Indonesia (Vol. SP 05/DKNS/OJK/1/2017): OJK.

Oliveira, T., Faria, M., Thomas, M. A., & Popovič, A. (2014). Extending the understanding of mobile banking adoption: When UTAUT meets TTF and ITM. International journal of information management, 34(5), 689-703.

Pavlou, P. A. (2003). Consumer acceptance of electronic commerce: Integrating trust and risk with the technology acceptance model. International journal of electronic commerce, 7(3), 101-134.

Sri Maharsi, F. F. (2006). Analisa Faktor-Faktor Yang Mempengaruhi Kepercayaan Dan Pengaruh Kepercayaan Terhadap Loyalitas Pengguna Internet Banking Di Surabaya. Jurnal Akuntansi dan Keuangan, 8(1), 35-51.

Sugiantoro, Y., & Isharijadi, I. (2015). Pengaruh Personalization, Computer Self Efficacy, dan Trust Terhadap Perceived Usefullness Pada Pengguna Internet Banking di PT. Bank BRI (Persero), tbk. Cabang Madiun. Assets: Jurnal Akuntansi dan Pendidikan, 4(1), 82-90.

Wagner, M. K. (2001). Behavioral characteristics related to substance abuse and risk-taking, sensation-seeking, anxiety sensitivity, and self reinforcement. Addictive behaviors, 26(1), 115-120.

Waluyo, C. A. (2018). Sejak awal tahun, bank sudah kurangi 341 kantor cabang. Retrieved 5 Mei, 2019, from https://keuangan.kontan.co.id/news/sejak-awal-tahun-bank-sudah-kurangi-341-kantor-cabang

Wang, S. W., Ngamsiriudom, W., & Hsieh, C.-H. (2015). Trust disposition, trust antecedents, trust, and behavioral intention. The Service Industries Journal, 35(10), 555-572.

Yiu, C. S., Grant, K., & Edgar, D. (2007). Factors affecting the adoption of Internet Banking in Hong Kong-implications for the banking sector. International journal of information management, 27(5), 336-351.

Zhou, T. (2012). Examining mobile banking user adoption from the perspectives of trust and flow experience. Information Technology and Management, 13(1), 27-37.

DOI: https://doi.org/10.30872/jakt.v16i2.6100

Refbacks

- There are currently no refbacks.

Copyright (c) 2019 Dianty Sonia Puruhita

Editorial Address

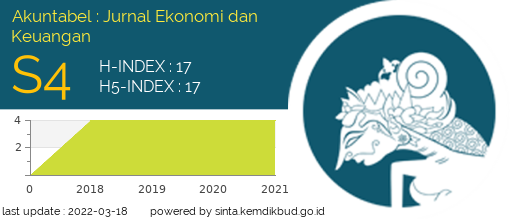

Akuntabel: Jurnal Akuntansi dan Keuangan

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jakt.feb.unmul@gmail.com

StatCounter: Akuntabel: Jurnal Akuntansi dan Keuangan