ANALISIS PENGARUH CAPITAL ADEQUANCY RATIO DAN NON PERFORMING LOAN TERHADAP RETURN ON ASSETS

Abstract

The purpose of this study is to analyze the impact of the variabels CAR and NPL on variable ROA on PT Bank Central Asia, Tbk. Research using financial statement data obtained on the basis of publication with quarterly time period 2003 to 2012. Analysis technique used is multiple linear regression analysis. Based on the statistical F indicates that model is fit because has a significance value less than 5% of Alpha Value (α). Meanwhile, result of the analysis show that predictive ability of this two independent variables, CAR and NPL, is 36,2% and it shown by adjusted R2 value, the rest 63,8 influenced by other variables outside the model. Based on statistical t test showed that the CAR and NPL is negative and no significant impact on ROA because it has a signifance value more than 5% of Alpha value (α). The result is expected that the variable CAR and NPL be relied upon, either by management company in managing the company, as well as by investors in determining the investment strategy.

Â

Keywords: CAR (Capital Adequancy Ratio); NPL (Non Performing Loan); ROA (Return on Assets)

DOI: https://doi.org/10.30872/jakt.v10i2.59

Refbacks

- There are currently no refbacks.

Copyright (c) 2013 Fibriyani Nur Khairin

Editorial Address

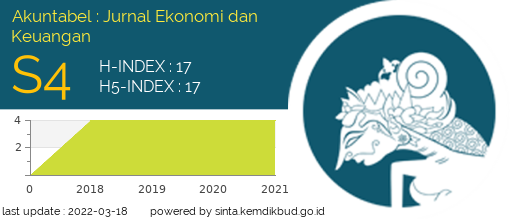

Akuntabel: Jurnal Akuntansi dan Keuangan

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jakt.feb.unmul@gmail.com

StatCounter: Akuntabel: Jurnal Akuntansi dan Keuangan