The perception of individual taxpayers against the intention of using e-form services

Abstract

This study aims to examine the perception of individual taxpayers against the intention of using e-form services. This research uses UTAUT model which is based on 4 main constructs which are Performance expectancy, effort expectancy, social influence and facilitating condition. Methods of data collection using online or manual questionnaires. The sample of research is individual taxpayers as much as 100 respondents. Data analysis using Structure Equation Model with Smart PLS 3.0 software. The results showed that Performance expectancy, effort expectancy, and social influence have no significant relationship whereas facilitating condition has a significant relationship.

Keywords

Full Text:

PDFReferences

Azmi, A. A. C., et al. 2012. Perceived Risk and the Adoption of Tax E-Filling. World Applied Sciences Journal, 20, 532-539.

Belanger, F., and Carter, L. 2008. Trust and risk in e-government adoption. Journal Of Strategic Information System, 17, 165-176.

Bhuasiri, W., et al. 2016. User Acceptance of e-government Services: Examining an e-tax Filling and Payment System in Thailand. Information Technology for Development.

Fu, J. R., et al. 2006. Acceptance of electronic tax filling: A study of taxpayer intentions. Information & Management, 43, 109-126.

Horst, M., et al. 2007. Perceived usefulness, personal experiences, risk perception and trust as determinants of adoption of e-government services in The Netherlands. Computers in Human Behavior, 23, 1838-1852.

Kurfah, M., et al. 2017. Adoption of e-government services in Turkey. Computers in Human Behavior, 66, 168-178.

Ling, L. A., et al. 2014. The Influence of e-Participation on e-Filling Participation: A Study of Citizen Adoption e-Government Services. International Journal of Engineering Science and Innovative Technology (IJESIT), 3(5), 251-260.

Mustapha, B., and Obid, S. N. B. S. 2015. Tax Service Quality: The Mediating Effect Of Perceived Ease of Use of the Online Tax System. Procedia Social and Behavioral Sciences, 172, 2-9.

Nam, T. 2014. Determining the type of e-government use. Government Information Quartely, 31, 211-220.

Venkatesh, V., et al. 2003. User Acceptance of Information Technology : Toward a Unified View. MIS Quarterly, 27(3), 425-478.

DOI: https://doi.org/10.30872/jakt.v16i2.5722

Refbacks

- There are currently no refbacks.

Copyright (c) 2019 Tapi Omas Annisa, Noorlailie Soewarno, Isnalita Isnalita

Editorial Address

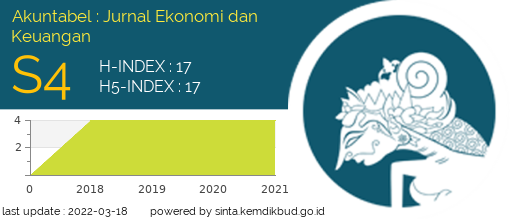

Akuntabel: Jurnal Akuntansi dan Keuangan

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jakt.feb.unmul@gmail.com

StatCounter: Akuntabel: Jurnal Akuntansi dan Keuangan