Kualitas Laba, Asimetri Informasi dan Biaya Modal Ekuitas

Abstract

Asymmetry of information makes investors act with different investment decisions because investors are faced with problem of the uncertainty over the risks and benefits of the investment. Information asymmetry that occurs raises transaction costs and reduces the liquidity of the shares the company is expected to increase the cost of equity capital. Gain more qualified (which reported the company) will reduce the level of information asymmetry. Decreased levels of information asymmetry occur because of high earnign quality suggest that management has reduced the relative adverse information and provide more information about the biases and do not feature the company’s financial performance. The low information asymmetry increases the sense of security and investor confidence in the company on its investment. This suggest that earning quality has a very important role in reducing information asymmetry and cost of equity capital, as investors and other market participants responding companies disclosed information.

Â

Keywords: earning quality, information asymmetry, cost of equity capital

Full Text:

PDFDOI: https://doi.org/10.30872/jakt.v10i2.56

Refbacks

- There are currently no refbacks.

Copyright (c) 2013 Ibnu Abni Lahaya

Editorial Address

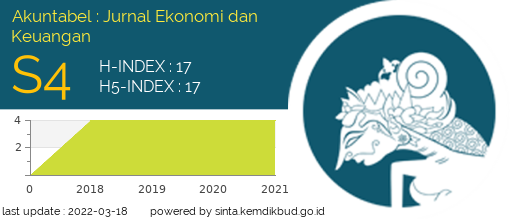

Akuntabel: Jurnal Akuntansi dan Keuangan

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jakt.feb.unmul@gmail.com

StatCounter: Akuntabel: Jurnal Akuntansi dan Keuangan