Apakah Informasi non-Keuangan berguna bagi Investor: Survei Persepsi bagi Investor Retail di Indonesia

Abstract

Currently investors in decision-making is more likely to use the company's financial statements, on the other side, they had appeared change the view that the non-financial information is more important and is already quite widely used by investors. This current study aims to examine the needs of non-financial information by investors. In This Research we uses survey Online to explore 113 respondents to dig up information on how they use non-financial information in the framework of the investment decision, the results showed that the use of performance information economy in the subsector information Market share and product innovation is predominantly used, then stage the second respondent uses information of employee satisfaction and customer satisfaction. Then the corporate governance seems very frequently used by respondents in the decision making elements of information governance as Director Independence Standards, changes in information control, auditing, ethical guidelines and information strategy management control system. Then to CSR shows the use of information that is at least in general, with the use of most existing information on the items Products Safety Information. This study contributes to the practitioner, especially investors in making investment decisions.

Keywords: non-financial information, performance information economy, corporate governance, CSRFull Text:

PDF (Bahasa Indonesia)References

Barber, B. M., and T. Odean. 2002. All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. Working paper, University of California, Davis.

Chua, W. F. 2006. Extended Performance Reporting: A Review of Empirical Studies. Sydney, New South Wales: The Institute of Chartered Accountants in Australia.

Cohen, J., Holder-Webb, L., Nath, L., and Wood D., 2011. Retail Investors’ Perceptions of the Decision-Usefulness of Economic Performance, Governance, and Corporate Social Responsibility Disclosures, Behavioral Research in Accounting Vol. 23, No. 1 2011 pp. 109–129.

Coram, P., G. Monroe, and D. R. Woodliff. 2009. The value of assurance on voluntary non-financial disclosure: An experimental evaluation. Auditing: A Journal of Practice & Theory _May_: 137–151.

Coram, P., T. J. Mock, and G. Monroe. 2006. An investigation into the use of non-financial performance indicators by financial analysts. Working paper, University of Melbourne.

Cormier, D., and M. Magnan. 2003. Environmental reporting management: A continental European perspective. Journal of Accounting and Public Policy 22 (1): 43–62.

Eccles, R., R. Herz, E. Keegan, and D. M. H. Phillips. 2001. The Value Reporting Revolution. New York, NY: John Wiley and Sons.

Epstein, M., and M. Freedman. 1994. Social disclosure and the individual investor. Accounting, Auditing and Accountability 7 _4_: 94–109.

Hawley, J., and A. Williams. 2000. The Rise of Fiduciary Capitalism: How Institutional Investors Can Make Corporate America More Democratic. Philadelphia, PA: University of Pennsylvania Press.

Huberman, G. 2001. Familiarity breeds investment. Review of Financial Studies 14 _3_: 659–680.

PricewaterhouseCoopers. 2002. Non-financial measures are highest-rated determinants of total shareholder value, PricewaterhouseCoopers finds. Management Barometer _April 22_.

Simnett, R., A. Vantraelen, and W. F. Chua. 2009. Assurance on sustainability reports: An international comparison. The Accounting Review. 84 _May_: 937–967.

DOI: https://doi.org/10.30872/jakt.v14i2.1906

Refbacks

- There are currently no refbacks.

Copyright (c) 2018 Muhammad Ikbal

Editorial Address

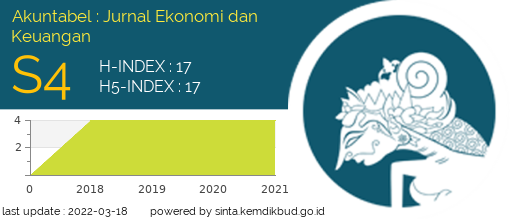

Akuntabel: Jurnal Akuntansi dan Keuangan

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jakt.feb.unmul@gmail.com

StatCounter: Akuntabel: Jurnal Akuntansi dan Keuangan