Pengaruh philanthrophy disclosure terhadap nilai perusahaan dengan profitabilitas sebagai variabel moderasi

Abstract

The aims of this research are to know : (1) The influence of philanthropy disclosure to firm value (2) The Influence of profitability to firm value and (3) The influence of Profitability as the moderating variable in relations between philanthropy disclosure and firm value. This research sample is philanthropy disclosure on all companies registered in Indonesian Stock Excange(IDX) in 2014 by using method of purposive sampling. There are 61 companies in 2014 which fulfilling criterion as this research sample. The analysis method of this research is Multiple Regression Analysis and Moderating Regression Analysis. The result of research show that the effect of philanthropy disclosure to firm value was no significant. While the effect profitability to firm value was positive significant. And profitability is can strengthen relation between philanthrophy disclosure and firm value.

Keyword: Philanthrophy Disclosure, Profitability, Firm Value

Full Text:

PDFReferences

Agustine, Ira. 2014.Pengaruh Corporate Social Responsibility Terhadap Nilai Perusahaan. FINESTA Vol. 2, No. 1, (2014) 42-47

Berman, S.L., Wicks, A. C., Kotha, S., dan jones, T. M. 1999. Does Stakeholder Orientation matter? The Relationship Between Stakeholder Management Models and Firm Financial Performance. Academy Of Management Journal.

Brid, Richard M, Vaillandcourt, Francois. 2007. Desentralisasi Fiskal Di Negara-negara Berkembang. PT Gramedia Pustaka Utama. Jakarta

Daniri, Mas Ahmad. 2008. Standarisasi Tanggung Jawab Sosial Perusahaan (Bag I).http//www.madani-ricom/2008/01/17/standarisasi-tanggung-jawab-sosial perusahaan-Bag-i/

Darwin, Ali .2004. Corporate Social Responsibility (CSR) Standar & Reporting. Seminar Nasional Universitas Katolik Soegijapranata.

Florence, Deviana., Suryanto, L., dan Zulaikha .2004. Pengaruh Karakteristik Perusahaan Terhadap Pengungkapan sosial Dalam laporan Tahunan Perusahaan Go Public Di BEJ. Journal maksi. Vol.4 Agustus: 161-177

Freeman, R.E. dan Wicks. A.C. 2004. Stakeholder Theory and Corporate Objective Revisited Organization Science, 15 (3) P. 363-369

Ghozali, Imam. 2013. Aplikasi Analisis Multivariate Dengan Program IBM SPSS 21.Semarang. Badan Penerbit UNDIP.

Ghozali, Imam dan A. Chariri. 2007. Teori Akuntansi. Badan Penerbit Universitas Diponegoro: Semarang.

Godfrey, Paul .C. 2005. Do Shareholders value Corporate Philanthropy?: An Event Study Test. Academy of Management Review. P: 777-798

Husnan, Suad. 2001. Dasar-dasar Teori Portofolio dan Analisis Sekuritas, Edisi Ketiga. Yogyakarta : UPP AMP YKPN.

Leisinger, Klaus. M and Schmitt, Karin, 2010. Corporate Social Responsibility and Corporate Philanthropy. Journal of Business Ethics.

Masulis, Ronald A and Syed Walid Reza. 2012. Agency Problems of Philanthropy. Australian School of Business University of New South Wales. P. 30

Nurlela, R dan Islahuddin, 2008. Pengaruh Corporate Social Responsibility Terhadap Nilai Perusahaan Dengan Persentasi Kepemilikan Manajemen sebagai Variabel Moderating. Simposium Nasional Akuntansi XL. Pontianak.

Kusumadilaga, Rimba. 2010. Pengaruh Corporate Social Responsibility Terhadap Nilai Perusahaan Dengan Profitabilitas Sebagai Variabel Moderating Studi Empiris Pada Perusahaan Manufaktur yang Terdaftar Di BEI.

Scott, William R. 2012. Financial Accounting Theory Sixth Edition. Toronto Pearson Prentice. P. 475

Sulistyani, 2007. Pengaruh Karakteristik Perusahaan Terhadap Pengungkapan Tanggungjawab Sosial dalam Laporan Tahunan Perusahaan Indeks Letter Quality (LQ 45) Tahun 2005. Aset. Volume 9 Nomor 2.Agustus. P.494-515

Sutrisno. 2012. Manajemen Keuangan Teori, Konsep dan Aplikasi Edisi Pertama.Ekonisia.Yogyakarta P. 222-223.

Zachary, Naomi Kerubo. 2011. Corporate Philanthropy As A Determinant Of Profitability Among Commercial Banks In Kenya. University of Nairobi.

DOI: https://doi.org/10.30872/jakt.v13i1.1174

Refbacks

- There are currently no refbacks.

Copyright (c) 2017 Siti Narsiah

Editorial Address

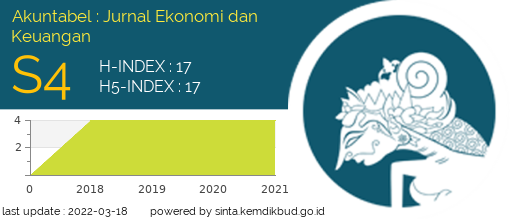

Akuntabel: Jurnal Akuntansi dan Keuangan

Faculty of Economics and Business, Mulawarman University

Jl. Tanah Grogot No.1 Samarinda Kalimantan Timur 75119

Email: jakt.feb.unmul@gmail.com

StatCounter: Akuntabel: Jurnal Akuntansi dan Keuangan